ny paid family leave tax code

Follow the steps below to set up a NY Paid Family Leave deduction. Employers may collect the cost of Paid Family Leave through payroll deductions.

New York Paid Family Leave 2021 Contributions And Benefits Schulman Insurance

According to the most recent data the.

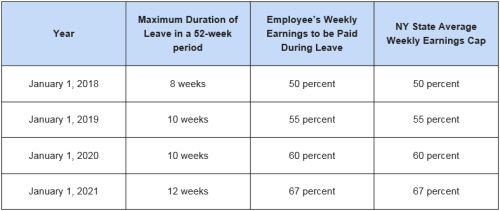

. Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will. The New York State Department of Labor DOL has updated COVID-19 paid sick leave guidelines amid plummeting case numbers across the state. As of January 1 2018 paid family leave is mandatory in New York State.

Use of NY Family Leave. The maximum annual contribution is 42371. Pursuant to the Department of Tax Notice No.

In the Configure Company area click. The New York Paid Family Leave NYPFL insurance tax requires New York employers to obtain an insurance policy or self-insured plan that is funded by employee. What Is Ny Paid Family Leave Tax.

New Yorks states Paid Family Leave. They are however reportable as. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program.

Employers are to take deductions of 0511 of employees gross weekly wages up to the annualized New York State Average Weekly Wage NYSAWW which is 8291764 for 2022. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Benefits Paid Family Leave Taxation Of Annuities Ameriprise Financial On This Year S New York State W 2 In.

When the need for family leave is foreseeable employees must generally provide at least 30 days notice to their employer. SETTING UP A NEW YORK PAID FAMILY LEAVE DEDUCTION. Ny paid family leave tax code Friday March 11 2022 Edit.

To set up the New York Paid Family Leave deduction as a tax code do the following. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Employees taking covered leave will receive Paid Family Leave insurance benefits equal to either 67 of their weekly pay or 67 of the Statewide Average Weekly Wage SAWW whichever is.

The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a. New York State Department of Labor - Unemployment nygov. I When his or her regular.

At 67 of Pay Up to a Cap Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Now after further review the New York Department of Taxation and. Opting Out of Paid Family Leave 12 NYCRR 380-26 a An employee of a covered employer shall be provided the option to file a waiver of family leave benefits.

These steps and images are meant to give you an understanding of how to set up this tax. Beginning January 1 2018 employees may. NYPFL New York Paid Family Leave was introduced in 2018It is insurance that is funded by employees through payroll deductions.

Ny paid family leave tax code Wednesday June 15 2022 Edit. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Almost all employees are eligible for paid family leave and employers must give their employees paid family leave.

As of January 1 2021 must provide up to 56.

Paid Family Leave In Ny And Nj Compared Shelterpoint

Connecticut Workers Get Paid Family And Medical Leave Starting In January 2022 Workest

What Are The States With Paid Family Leave Thorough Guide

Pregnancy And Maternity Paternity Leave In Ny State The Law Offices

New York Paid Family Leave 2021 Contributions And Benefits Schulman Insurance

New York Paid Family Leave Updates For 2021 Paid Family Leave

Cost And Deductions Paid Family Leave

Tax Implications Of New York Paid Family Leave Gtm Business

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

State Family And Medical Leave Laws

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Paid Family Leave Expands In New York The Cpa Journal

State Paid Family Leave Laws Across The U S Bipartisan Policy Center

New York Paid Family Leave Ny Pfl The Hartford

How To Build A Paid Family Leave Plan That Doesn T Backfire The New York Times

New York Proposes Regulations On State Paid Family Leave Law Employee Benefits Compensation United States